Inheritance Tax Avoidance

Personal tax advice, business related tax, plus non-domiciled tax planning, pension reviews and NOW pension release.

Tax Advice Consultants

It makes sense to get the best advice possible when it comes to tax. If you already know what you want …….go straight to the tax advice you require…..

We can help you with all of your tax problems :-

PENSION FUNDS – Offshore

UK TAX – Income tax, Capital gains tax avoidance, Inheritance tax avoidance, Stamp Duty Rates

BUSINESS TAX – Corporation Tax, Contractor tax, Employee benefit trusts

LIVING ABROAD – Non-domiciled workers

Inheritance Tax

Many people have become involved with inheritance tax as result of the soaring house boom. It is a tax based on all you own at your death. Many of us are looking at methods of inheritance tax avoidance.

Many people have become involved with inheritance tax as result of the soaring house boom. It is a tax based on all you own at your death. Many of us are looking at methods of inheritance tax avoidance.

The value of your estate will include your savings, your house and other properties, your financial investments, any personal possessions, even the contents of your wine cellar if they are valuable.

Up to £325,000 is free from tax, however, in 15 years ago in 1992 it was £150,000. to give an idea of how ‘property wealth’ has pushed the threshold up.

If it is likely that these possessions are likely to be passed to children it is a good idea to do a bit of forward tax planning, you can ‘gift’ some possessions, but they are only free from tax if that was 7 years previously, otherwise you will end up paying a percentage.

Inheritance Tax Avoidance

The tax has to be paid in full before the balance of the estate can be passed on to the rest of the family, so planning your tax affairs so that inheritance tax avoidance can occur starts with your will. It can make a big difference to the final amount of tax that will be due on settling your affairs. As we all know planning it with a cool head might also help your family get through a tricky time.

Get in contact if you have questions about inheritance tax avoidance that need clarification relating to your will whether you have written it or not!

Keep your hard earned money

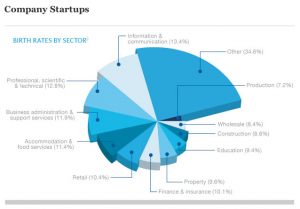

Recent figures show that 90,000 new businesses were created in the United Kingdom in the first 6 months of 2013, this is an increase of 3.4% on the previous year.

The number of entrepreneurial small business in the Britain has reached 2.8 million being 2.73 million the previous year.

A vast majority of these entrepreneurs could benefit from a bit of tax planning advice. The two most popular areas are Capital gains tax avoidance and inheritance tax avoidance.

In the first half of 2013, over 90,000 new ventures were started. The United kingdom is now a nation of entrepreneurs, with 49% of startup businesses being able to set up their company with less than £2,000. What is even more interesting is that 10% needed no funding to commence trading at all.

Company Startups

However, you start your business either as a Limited company, a sole trader or as a Limited Liability partnership your planning for tax is obviously important.

Rates of tax and new laws to cover rapidly changing commercial markets are far too numerous to follow. Many of us just want to concentrate on making money! It pays to get a specialist to set up a strategy by seeking professional advice.

If you wish to do so tell us about your needs through the contact form.

How do Tax Planning Specialists Work?

If you are in business as a company director, partner or sole trader you will already have an accountant. You are fully entitled to keep as much money as you can. Your accountant will have already prepared your accounts and made you aware of your allowances.

However, it is the detail of the tax laws that often leads to the greatest tax savings and it is these tax details that the specialist excels in saving you often large amounts in personal or business tax. You may well think that the tax specialist is too expensive for your pocket. It is important to remember that Tax specialists generally only get paid if they manage to save you money, they don’t typically charge by the hour. Consider your situation and decide whether you can get the full benefits of a tax specialist. Initial clarification of say your, capital gains tax avoidance is free.

Tax consultants regularly cut client’s tax significantly. This is always done by using the existing tax framework of law, because of their experience and skill this is done without breaking any UK laws. It is simply a case of studying the tax regulations in detail, something the authors of the tax are not always able to do.

In fact if you request about the laws relating to inheritance tax avoidance or capital gains tax advice or have a question from HMRC there is a 25% chance that the information is wrong, incomplete or contradictory.

There is no need to develop or invent a new tax scheme. Simply using the precedent of the old ones and benefiting from them.

The format is often an introduction by e-mail covering the circumstances and tax needs, followed by a chat on the phone or meeting for a coffee.

Typically our clients are successful in they own area of business, as is the tax specialist who is an expert at helping you with inheritance tax avoidance.

How to use the Online Tax Calculator

In the column on the right hand side you will find the free online tax calculator. This will calculate your tax if you know your tax details and allowances. Simply type in your income together with your date of birth into the online tax calculator and click on the keypad.

The online tax calculator has a facility to take into account student loans.

If you are unsure about your allowances or need some tax planning advice, such as inheritance tax avoidance, then click the button below or help.

Tag cloud: Inheritance Tax Avoidance, Advice on tax reduction, inheritance tax, non-domiciled tax issues, pension swaps, pension reviews, overseas workers, corporate and personal tax.

Inheritance tax advice, Inheritance tax consultants, tax elimination, tax efficiency, tax consultants, accountants, tax advisers, tax avoidance advisers, tax avoidance consultants, Inheritance tax avoidance, Inheritance tax advice, Inheritance tax specialists, k2, k2 tax scheme, k2 offshore tax, offshore banking, tax havens, guernsey, jersey, isle of man, switzerland, pension review, pension advice, pension consultants, tax planning.

www.taunton-tax-planning.co.uk

www.bristol-website-seo.co.uk

www.cheltenham-seo-consultants.co.uk

www.hereford-seo-consultants.co.uk